y-j.site

Overview

How Much Will My Fixed Rate Mortgage Payment Be

Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Find out how much your monthly mortgage payment could be, based on your How much will depreciation cost me? Help. In this tool, the results display. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. How to use the calculator To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. The amount you believe that your mortgage's interest rate will. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Multiply the factor shown by the number of thousands in your mortgage amount, and the result is your monthly principal and interest payment. For the total cost. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Find out how much your monthly mortgage payment could be, based on your How much will depreciation cost me? Help. In this tool, the results display. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. How to use the calculator To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. The amount you believe that your mortgage's interest rate will. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Multiply the factor shown by the number of thousands in your mortgage amount, and the result is your monthly principal and interest payment. For the total cost. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Loan amount. Interest rate.

How does my credit rating affect my home loan interest rate? Do I need to ARM interest rates and payments are subject to increase after the initial fixed-rate. Use our simple mortgage calculator to quickly estimate monthly payments for your new home. This free mortgage tool includes principal and interest. A mortgage is a long-term loan designed to help you buy a house. In addition to repaying the principal, you also have to make interest payments to the. The mortgage interest rate is paid annually, so divide the rate by 12 to get the monthly rate. For example, a 6% rate would be % (formatted as ). n. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. To determine your mortgage payment — or the amount you'll pay each month, not including taxes and insurance — you'll need your loan amount, interest rate, and. How much will my fixed rate mortgage payment be? This calculator computes the payments (principal and interest) for a fixed rate loan. All fields are required. Or would you prefer to make larger payments, but over a shorter period of time? The loan amount could vary too, based on how much of your assets you're willing. Use this calculator to generate an estimated amortization schedule for your current mortgage. Quickly see how much interest you could pay and your estimated. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. This calculator computes the payments (principal and interest) for a fixed rate loan. All fields are required. For example, if your interest rate is 3%, then the monthly rate will look like this: /12 = n = the number of payments over the lifetime of the loan. Estimate my monthly mortgage payment. The loan amount, the interest rate, and the term of the mortgage can have a dramatic effect on the total amount you will. For example, let's say that John wants to purchase a house that costs $, and has saved up a $25, down payment. His loan amount (A) is $,, the. How to Calculate Monthly Mortgage Payments Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by. A mortgage is a long-term loan designed to help you buy a house. In addition to repaying the principal, you also have to make interest payments to the. How much of a down payment do you need? To get the best mortgage interest rates and terms, you'll want a down. The amortization schedule details how much will go toward each component of your mortgage payment — principal or interest — at various times throughout the loan. Today's mortgage rates. Interest rates vary depending on the type of mortgage you choose. See the differences and how they can impact your monthly payment.

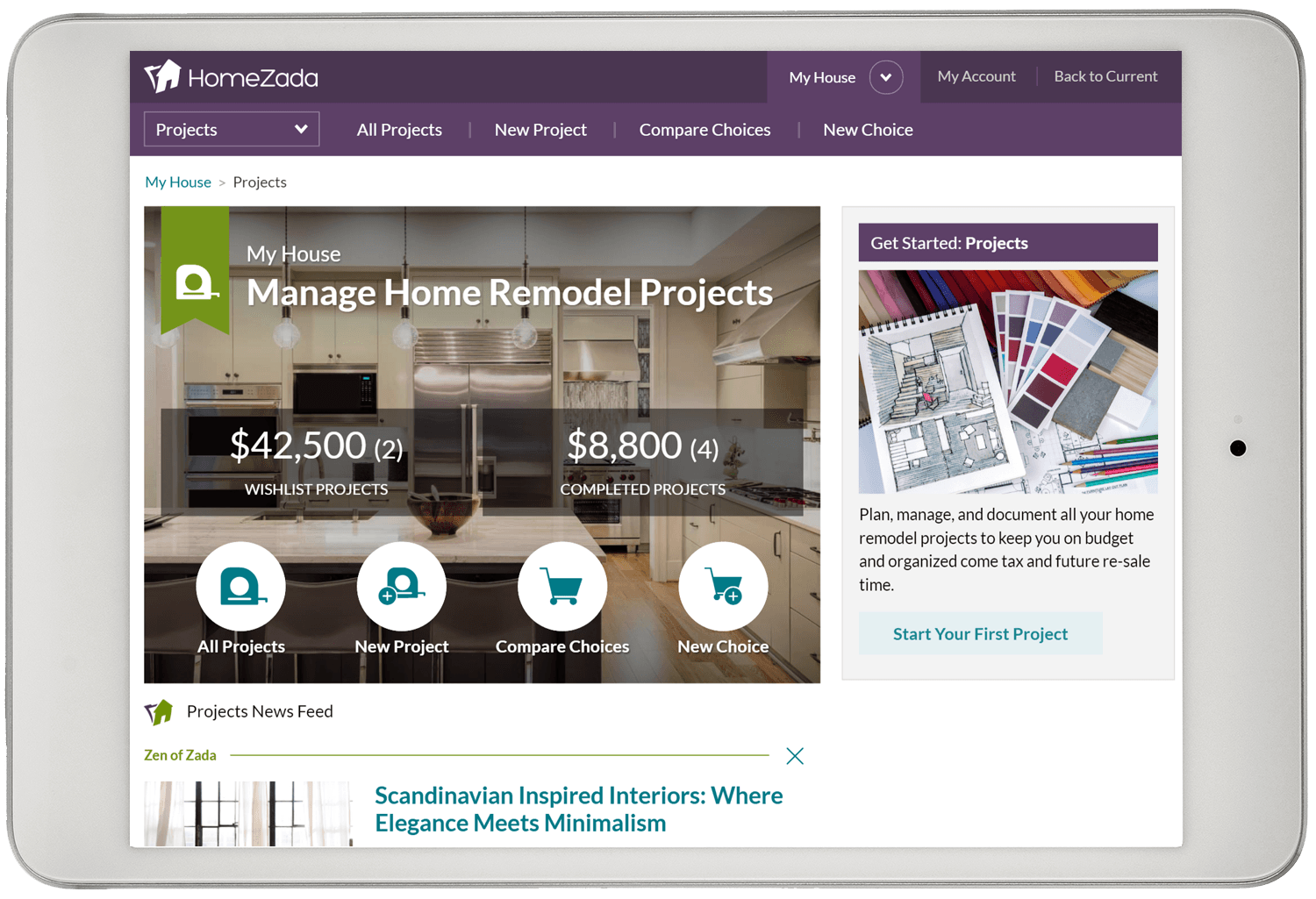

Remodel Program

Professional remodeling software for additions, basement remodeling, and kitchen & bath remodeling. Easily gather as-built measurements, create client. Save Money and Control Your Remodel Projects HomeZada helps you create a budget for all the items on your project, regardless of whether you DIY or hire a. HUD Title 1 property improvement loan program. You can use HUD Title 1 property improvement loans for remodeling your property, repairs, or other improvements. With flexible courses and no exam due dates, you can earn your diploma on your schedule, from home. Penn Foster's home repair classes cover a range of home. We additionally provide funding to these program partners that enable eligible homeowners to make necessary repairs and accessibility improvements, allowing. Home renovation or remodeling requires both architectural and financial planning. Learn how to set a budget, hire a contractor, and much more. Chief Architect offers realistic 3D rendering technology that makes your ideas come to life and helps your clients visualize their remodel project. You can. STC's home renovation training program covers the basics of carpentry, plumbing, electrical, and other trades for aspiring professionals. Enrol today! Government programs can make home repairs and renovations more affordable. Find out if you are eligible for home improvement loans and learn how to apply. Professional remodeling software for additions, basement remodeling, and kitchen & bath remodeling. Easily gather as-built measurements, create client. Save Money and Control Your Remodel Projects HomeZada helps you create a budget for all the items on your project, regardless of whether you DIY or hire a. HUD Title 1 property improvement loan program. You can use HUD Title 1 property improvement loans for remodeling your property, repairs, or other improvements. With flexible courses and no exam due dates, you can earn your diploma on your schedule, from home. Penn Foster's home repair classes cover a range of home. We additionally provide funding to these program partners that enable eligible homeowners to make necessary repairs and accessibility improvements, allowing. Home renovation or remodeling requires both architectural and financial planning. Learn how to set a budget, hire a contractor, and much more. Chief Architect offers realistic 3D rendering technology that makes your ideas come to life and helps your clients visualize their remodel project. You can. STC's home renovation training program covers the basics of carpentry, plumbing, electrical, and other trades for aspiring professionals. Enrol today! Government programs can make home repairs and renovations more affordable. Find out if you are eligible for home improvement loans and learn how to apply.

Details of Continuing Education Home Renovation Basics Program offered at George Brown College in Toronto, Ontario, Canada. Program courses can also be. Whether your borrowers are just starting their homebuying search or ready to refinance and remodel, HomeStyle Renovation can pave a new way to home. HomeStyle. Administering the program, hiring staff, and implementing systems and data management tools designed to maximize enrollment in all existing home repair programs. Home Remodeling CAD Software. Home remodeling CAD software from CAD Pro provides all the necessary design tools and symbols for any type of home remodeling. Our house remodel app has got you covered in every way, with professionally made templates, easy-to-use building tools, a wide selection of items, and much. Build energy efficiency into your renovation or addition to drive comfort and savings. A group of people discussing renovation plans. Back to Programs &. The Home Repair Program provides loans and grants for the repair of owner-occupied homes. If you would like more information on these programs, please call . Construction, building and renovation programs at Ontario colleges provide not only skills training, but also the mathematical, business and project planning. What is a Construction & Building Skills program? A construction trade school provides hands-on learning to students who wish to pursue work in the construction. Also known as the Section Home Repair program, this provides loans to very-low-income homeowners to repair, improve or modernize their homes or grants to. SmartDraw helps you plan and complete any remodel project with intuitive tools and templates. Simply start by selecting one of the many built-in floor plan. Financing program helping affordable housing providers complete deep Funding opportunities for housing construction and renovation on and off reserve. Home Design Software · Christian Mortiz RoomSketcher Testimonial. “RoomSketcher is an easy-to-use tool to create fast visualizable floor plans for remodeling or. The Residential Emergency Services to Offer (Home) Repairs to the Elderly (RESTORE) program provides financial resources to assist senior citizen homeowners. Americans spend more than $ billion a year on residential renovations and repairs. For over two decades, our Remodeling Futures Program has studied. Provincial Home Repair Program (PHRP). Click Here for Applications. Program Description. Through Newfoundland and Labrador Housing Corporation (NLHC). Home renovation or remodeling requires both architectural and financial planning. Learn how to set a budget, hire a contractor, and much more. Ready to upgrade your home? Alaska Housing provides renovation options covering three possible scenarios: Purchase Renovation. Renovations in conjunction with a. The Home Renovation Rebate Program and CleanBC Home Efficiency Rebates is a partnership between BC Hydro, FortisBC and CleanBC. The partner program provides. The program provides access to affordable low- or no-interest and potentially forgivable loans for home repairs to eligible owners of one- to four-family homes.

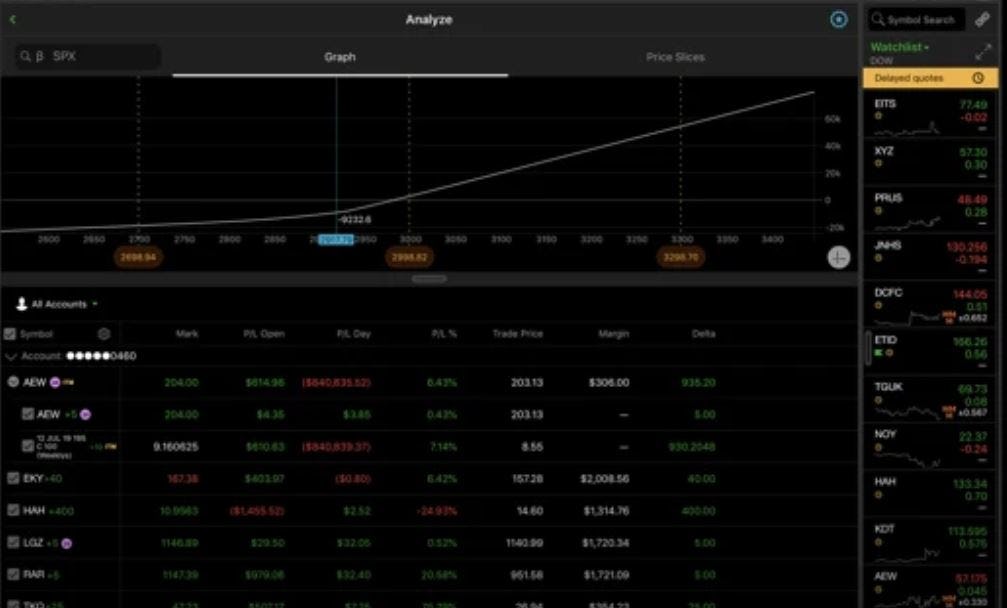

Cost Of Thinkorswim Platform

Taking the essential trading functionality from the thinkorswim desktop, this platform is streamlined and optimized for web access. fees (standard pricing. Bookmap trading platform packages to find the perfect fit for your trading needs. Discover transparent pricing and features tailored to enhance your market. According to the ThinkorSwim commissions page, there is no fee for online stock and ETF trades. It's the same for options trading, but you have to pay $ fee. As a result, the thinkorswim platform offers the best tools for advanced traders. However, Fidelity is a low-cost brokerage with top-notch trade execution. ThinkorSwim (TOS) is a free trading platform. All you need to do is fund your account. They also have a simulated trading account that you can use. Call, and. Explore our full array of trading tools including the suite of thinkorswim® platforms. cost. Charles Schwab SG Pte. Ltd. (Reg. No. D) holder. Here you'll find Schwab's pricing, account fees, and commissions. Our new commission-free trading makes trading stocks, ETFs, and options easier than ever. Fee Commission Rate. 5 $ and $ rates are for online and mobile Like we have those within our Thinkorswim platform, for example, in the. It's the same for options trading, but you have to pay $ fee per contract. A $ fee per contract is applied to Futures and Options on Futures. Does. Taking the essential trading functionality from the thinkorswim desktop, this platform is streamlined and optimized for web access. fees (standard pricing. Bookmap trading platform packages to find the perfect fit for your trading needs. Discover transparent pricing and features tailored to enhance your market. According to the ThinkorSwim commissions page, there is no fee for online stock and ETF trades. It's the same for options trading, but you have to pay $ fee. As a result, the thinkorswim platform offers the best tools for advanced traders. However, Fidelity is a low-cost brokerage with top-notch trade execution. ThinkorSwim (TOS) is a free trading platform. All you need to do is fund your account. They also have a simulated trading account that you can use. Call, and. Explore our full array of trading tools including the suite of thinkorswim® platforms. cost. Charles Schwab SG Pte. Ltd. (Reg. No. D) holder. Here you'll find Schwab's pricing, account fees, and commissions. Our new commission-free trading makes trading stocks, ETFs, and options easier than ever. Fee Commission Rate. 5 $ and $ rates are for online and mobile Like we have those within our Thinkorswim platform, for example, in the. It's the same for options trading, but you have to pay $ fee per contract. A $ fee per contract is applied to Futures and Options on Futures. Does.

However, options trades come with a $ per contract fee. Futures and forex trading do involve commissions, which are detailed on TD Ameritrade's pricing page. Overview · Cost per stock/ETF trade: $ per share, with $1 minimum, or free on Lite tier · Cost per options trade: $ per contract. HTML clipboard Because Ameritrade acquired thinkorswim (their brokerage platform) for $ millions in The Ameritrade simply prefer to. Options trades will be subject to the standard $ per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). Thinkorswim charges a standard commission of $0 per trade plus an additional $ per contract for options commissions or option trades. Thinkorswim charges a standard commission of $0 per trade plus an additional $ per contract for options commissions or option trades. All TD Ameritrade platforms have advanced features, with ThinkOrSwim Web being the only trading platform that does not grant access to Level II Price Quotes on. The Thinkorswim platform is free to use. It provides a sophisticated set of capabilities without any associated costs for accessing the platform itself . The Thinkorswim platform is free to use. It provides a sophisticated set of capabilities without any associated costs for accessing the platform itself . Margin rates among the most competitive in the industry—as low as %. No minimums to open an account. $ commissions. No platform fees. No data fees. No. Stocks, ETFs, and closed-end funds now cost $0 per trade. · Options have no base charge; although there is a 65¢ fee per contract. · Futures cost $ per side. Chart drawings will sync within the thinkorswim suite of platforms. Glance That's a 3 step process and a lot can happen in those 3 steps that can cost u money. Tastytrade's pricing compares favorably to the $ per contract charge for both entering and exiting an options trade that is common across online brokers. In each of these gadgets, you can view the best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. Here is how you can. AThinkorswim is a web-based platform. So, you need not download any software or app to use it. QHow does the Thinkorswim Stock Market. Is there a place I can learn more information about thinkorswim, similar to the Streetsmart Edge manual? I have my thinkorswim platform setup exactly how I. thinkorswim platform. Trailing Stop Links · thinkScript in Conditional Orders. Order Types, What They Mean. Market. Seeks execution at the next available price. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies; get support;. TD Ameritrade created a highly regarded trading platform called Thinkorswim, which is used by new investors and experienced traders alike. The company also. Market Data Costs, $5/mo for Gold, Free ; Leverage, 4x, 4x ; Futures and Forex, Extremely Limited, Yes ; Crypto, Yes, No.

What Are Some Long Term Investments

:max_bytes(150000):strip_icc()/longterminvestments.asp-final-351e853ae8a44d2ea9197632266905e5.png)

Passive investing, sometimes called buy-and-hold, is a popular investment approach where you invest in stocks and other securities with the intention of holding. Best long-term stocks to buy now · UnitedHealth (UNH) · Elevance Health (ELV) · Applied Materials (AMAT) · Alibaba Group Holding Ltd (BABA) · Cisco Systems Inc. Five principles for a long-term investment strategy · 1. Match your investments to your goals · 2. Spread your 'eggs' among multiple baskets · 3. Don't try timing. investment decisions without considering their long-term financial goals. All investments involve some degree of risk. If you intend to purchase. When the value of those assets drops, regular contributions means you can buy them at a reduced cost, and then reap the rewards when the market rises again. I've tried looking for the best plans available (Old Mutual, Allan Gray etc.), but I'm still a bit lost. What companies offer good long term investment options? Bonds. Bonds are generally considered relatively safe long-term investments, acting as a loan from an investor to an entity such as the government or a company. The world's largest asset owners include pension funds, insurance firms, sovereign wealth funds, and mutual funds (which collect individual investors' money. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund. Passive investing, sometimes called buy-and-hold, is a popular investment approach where you invest in stocks and other securities with the intention of holding. Best long-term stocks to buy now · UnitedHealth (UNH) · Elevance Health (ELV) · Applied Materials (AMAT) · Alibaba Group Holding Ltd (BABA) · Cisco Systems Inc. Five principles for a long-term investment strategy · 1. Match your investments to your goals · 2. Spread your 'eggs' among multiple baskets · 3. Don't try timing. investment decisions without considering their long-term financial goals. All investments involve some degree of risk. If you intend to purchase. When the value of those assets drops, regular contributions means you can buy them at a reduced cost, and then reap the rewards when the market rises again. I've tried looking for the best plans available (Old Mutual, Allan Gray etc.), but I'm still a bit lost. What companies offer good long term investment options? Bonds. Bonds are generally considered relatively safe long-term investments, acting as a loan from an investor to an entity such as the government or a company. The world's largest asset owners include pension funds, insurance firms, sovereign wealth funds, and mutual funds (which collect individual investors' money. INFORMATION REGARDING MUTUAL FUNDS/ETF: Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund.

One of the benefits of long-term investing is the potential for market growth. Stock markets may fluctuate daily during particularly volatile periods, but if. What are the benefits of long-term investing? · It could help ride out the market bumps · It gives your money more time to potentially grow · It means less. 1. Stock Mutual Funds By investing in diversified stock portfolios, stock mutual funds have the potential to produce greater returns over the. Various long-term investment plans with high returns in India · Gold · Public Provident Funds (PPFs) · Mutual funds · Stocks · Fixed deposits. 10 Tips for Successful Long-Term Investing · Keep Taxes in Mind, But Don't Worry · 9. Be Open-Minded · 8. Adopt a Long-Term Perspective · 7. Focus on the Future. If you know you are going to need your money in three to five years, consider investing it in the stock market — but more conservatively. “You want to keep at. Generally, any asset you hold for over five years is considered a long-term investment and you usually distribute your money across a range of assets to build a. Influential securities are classified as long-term investments. The equity method of accounting and consolidation accounting rules then apply. If you own over. Long-term investment options include ULIPs, mutual funds, public provident funds, fixed deposits, gold, and national pension schemes. These choices offer the. Long-term investing is likely to lead to meaningful wealth creation in the long term. Many individuals who lack the expertise required to participate in. What do you consider to be the best investments for long term security? · invest a chunk of the money monthly in a Target date fund. · another. Short-term investments like Treasury bills, high-yield savings accounts, short-dated CDs, money market accounts, and government bonds offer some of the best. What is long-term investing? Long-term investing is a commitment to keeping your money in the stock market for an extended period of time (often 10 years or. Short-term investing goals may take months or a few years. Examples of short-term investing goals can include saving for a vacation, wedding or home improvement. The world's largest asset owners include pension funds, insurance firms, sovereign wealth funds, and mutual funds (which collect individual investors' money. On the other hand, long-term investors aim to hold investment vehicles, such as stocks, bonds, or derivative contracts for several years. Short-Term Investing. When a company owns less than 50% of the outstanding stock of another company as a long-term investment, the percentage of ownership determines whether to. Long-term goals: More than 10 years · Individual common stocks · Stock mutual funds, closed-end stock funds (CEF), stock unit investment trust (UIT), stock ETFs. What Is a Short-Term Investment? Short-term investments are assets that investors hold for less than five years. Investors typically use these investments to.

Cd Rates In Maryland

For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. The Best Maryland Certificate of Deposit (CD) Rates [Updated: December ] ; 5-Year CD Rate, BMO Alto, %, $1, 5-Year Annuity Rate ; 3-Year CD Rate. Top Local Branch Rates ; %. PNC BankPNC High Yield Savings · %. Capital One ; %. PNC BankVirtual Wallet® Checking Pro · %. CFG Bank ; %. First. Looking for home mortgage rates in Maryland? View loan interest rates from local banks, MD credit unions and brokers, from y-j.site Regular CD/IRA Accounts ; 12 - 17 Months, $, $, %, % ; 18 - 23 Months, $, $, %, %. Lock in a fixed interest rate with flexible terms to grow your savings when you open a Certificate of Deposit (CD) with M&T. Best 3-Month CD Rates · Bask Bank, % APY ; Best 6-Month CD Rates · American Airlines, % APY ; Best Month CD Rates · Cyprus Credit Union, % APY ; Best 2. Certificate of Deposit Rates ; %, Monthly, $10, ; %, Monthly, $10, Certificate of Deposit (CD) Rates ; 5-year Step-Up. %. APY* ; 4 years | Open Now. %. APY* ; 3 years | Open Now. %. APY* ; 30 months | Open Now. %. For Featured CD Account · % ; For Standard Term CD Account · % ; For Flexible CD Account · %. The Best Maryland Certificate of Deposit (CD) Rates [Updated: December ] ; 5-Year CD Rate, BMO Alto, %, $1, 5-Year Annuity Rate ; 3-Year CD Rate. Top Local Branch Rates ; %. PNC BankPNC High Yield Savings · %. Capital One ; %. PNC BankVirtual Wallet® Checking Pro · %. CFG Bank ; %. First. Looking for home mortgage rates in Maryland? View loan interest rates from local banks, MD credit unions and brokers, from y-j.site Regular CD/IRA Accounts ; 12 - 17 Months, $, $, %, % ; 18 - 23 Months, $, $, %, %. Lock in a fixed interest rate with flexible terms to grow your savings when you open a Certificate of Deposit (CD) with M&T. Best 3-Month CD Rates · Bask Bank, % APY ; Best 6-Month CD Rates · American Airlines, % APY ; Best Month CD Rates · Cyprus Credit Union, % APY ; Best 2. Certificate of Deposit Rates ; %, Monthly, $10, ; %, Monthly, $10, Certificate of Deposit (CD) Rates ; 5-year Step-Up. %. APY* ; 4 years | Open Now. %. APY* ; 3 years | Open Now. %. APY* ; 30 months | Open Now. %.

Certificate of Deposit Rates · 1 Year, 3%, %, $ · 2 Years, %, %, $ · 3 Years. See our highest CD Special offers · % APY 5 Month,* % APY 7 Month** or % APY 13 Month CD Specials*** · With any account, you also get the latest in. % APY Month Term Certificate Of Deposit; % APY Money Manager Plus Account. See current rates! First Peoples Community Federal Credit Union is a full-service financial institution with branches in Maryland, Pennsylvania and West. CD Specials ; TERM, MINIMUM OPENING BALANCE, RATE ; 8-Month · CD Special», $, %1 APY ; Month · CD Special», $2,, %2 APY. If you are looking for the best Certificate of Deposit rates on the market, then you need to see Queenstown Bank of Maryland. They are that good! Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. CD Promotion ; Flexible Terms. (7 days to 10 years) ; Fixed Rate of Return. (typically higher rates with longer terms) ; FDIC Insured. (up to $,). EagleBank offers the best 6-month and 1-year CD rates at U.S. banks. If you're unfamiliar with EagleBank, it's a local financial institution in Maryland. CD Rates* · Days. %, %, $ · Months, %, %, $ · Months, %, %, $ · Months, %, %, $ · Summary of best 1-year CD rates · First Internet Bank: % APY. · Bread Savings™️: % APY. · CIBC Agility™: % APY. · TAB Bank: % APY. · Bask Bank: %. Certificates of Deposit from MECU Credit Union in MD offer higher rates than regular savings accounts. View CD rates on our website and start saving more. Freedom Federal Credit Union (MD) CD Rates ; %, $, - ; %, $, - ; %, $50k, - ; %, $, -. The highest 1-month CD rate today is % from Merchants Bank of Indiana. Best 3-month CD rates. The highest 3. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Rate adjustable CD's are available. Each of these RAD Certificates permit Copyright © Queenstown Bank of Maryland. All Rights Reserved. NMLS. The top certificate of deposit rates from banks And credit unions In Bel Air, Maryland. Rosedale Federal offers a variety of CDs. ; 48 Months - Bump Up, $10,, $10,, %, % ; 60 Months, $, $, %, %. CDs are a great way to save. · Flexible Terms – 7 Days to 10 Years · Fixed Rate of Return (typically higher rates with longer terms) · FDIC Insured up to $, The minimum balance requirement to open an online CD account is $1, How are funds transferred into my online CD account? Funds can be transferred from an.

Small Business Buy Sell Agreement

A Buy-Sell Agreement is a legally binding contract that lays out the parameters under which shares in a business can be bought or sold. A Buy-Sell agreement is. A well-drafted buy-sell agreement can go a long way toward ensuring the multigenerational longevity of a family business and to protect the family. A buy-sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity. It sets out rules and. Buy-sell agreements are far more important legal and business documents than most business owners believe. If triggered, your buy-sell agreement will. A buy sell agreement provides for an orderly disposition of business interests and is beneficial in setting the value for estate tax purposes. In General. An. A buy/sell agreement (or buyout agreement) exists to help business owners ensure the continuity of their business after the loss of an owner. Frequently, buy-sell agreements give the remaining owners the first option to purchase the business proportionately. However, in the event that the owners do. If you co-own a business, you need a buy-sell agreement. Also called a buyout agreement, this document is essentially the business world's equivalent of a. If you're wondering about the benefits of buy-sell agreements, we compare 3 main types and answer some of your top questions. A Buy-Sell Agreement is a legally binding contract that lays out the parameters under which shares in a business can be bought or sold. A Buy-Sell agreement is. A well-drafted buy-sell agreement can go a long way toward ensuring the multigenerational longevity of a family business and to protect the family. A buy-sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity. It sets out rules and. Buy-sell agreements are far more important legal and business documents than most business owners believe. If triggered, your buy-sell agreement will. A buy sell agreement provides for an orderly disposition of business interests and is beneficial in setting the value for estate tax purposes. In General. An. A buy/sell agreement (or buyout agreement) exists to help business owners ensure the continuity of their business after the loss of an owner. Frequently, buy-sell agreements give the remaining owners the first option to purchase the business proportionately. However, in the event that the owners do. If you co-own a business, you need a buy-sell agreement. Also called a buyout agreement, this document is essentially the business world's equivalent of a. If you're wondering about the benefits of buy-sell agreements, we compare 3 main types and answer some of your top questions.

A buy-sell agreement, or buyout agreement, is a legal contract outlining what happens to a co-owner or partner's shares if they die or want/need to leave. The buy-sell agreement specifies exactly who will continue as owners in the business. The agreement can be used to ensure that the people who have been running. What Does a Buy-Sell Agreement Mean for Small Businesses. September 28, Buy-sell agreements are incredibly important for small businesses with. A buy-sell agreement is an agreement or contract that governs what happens to an LLC membership interest or corporate shareholder's interest when the co-owner. A buy-sell agreement is a legally binding contract between co-owners that determines the course of action if a co-owner chooses or is forced to leave a business. A buy-sell agreement is a legally binding contract for managing an ownership transition if an owner departs the business. Also called a buyout agreement, these. Liberty Legal Solutions, LLC, is committed to answering your questions about Business Law, Contracts & Agreements, Business Litigation including Breach of. Class Description. Buy-sell agreements are drafted by attorneys who incorporate important legal provisions. Yet without your guidance, these agreements make. A buy/sell agreement (or buyout agreement) exists to help business owners ensure the continuity of their business after the loss of an owner. A Buy-Sell Agreement, which is a contractual agreement between shareholders and their corporation or between a shareholder and the other shareholders of the. A buy-sell agreement is a legal document used by business owners and shareholders to outline terms for transferring ownership interests in specific. A buy-sell agreement is a key component of business succession planning, particularly for small businesses with two or more family groups in the ownership. Instead, buy sell agreements are contracts that link co-owners of businesses together and controls when owners can sell their respective interests in a company. A Buy-Sell Agreement, which is a contractual agreement between shareholders and their corporation or between a shareholder and the other shareholders of the. A buy-sell (buy and sell, buyout, or business prenup) agreement is a contract that describes how a partner's share of a business is distributed if that partner. A typical buy-sell agreement for a family business provides that, on the death or departure of one shareholder, the remaining shareholders have the right to. This Buy-Sell Agreement (this "Agreement") is made effective as of., between and among. (the "Company") and each of the individuals listed on the attached. A buy-sell agreement is a legally binding agreement between business partners or co-owners that outlines the terms and conditions for buying out a departing. Buy/Sell Agreements are drafted by attorneys who incorporate important legal provisions. But what about those paragraphs dealing with the valuation provisions? A purchase and sale agreement should list the names of the seller(s), buyer(s), including any partners who hold an interest in the business. No parties involved.

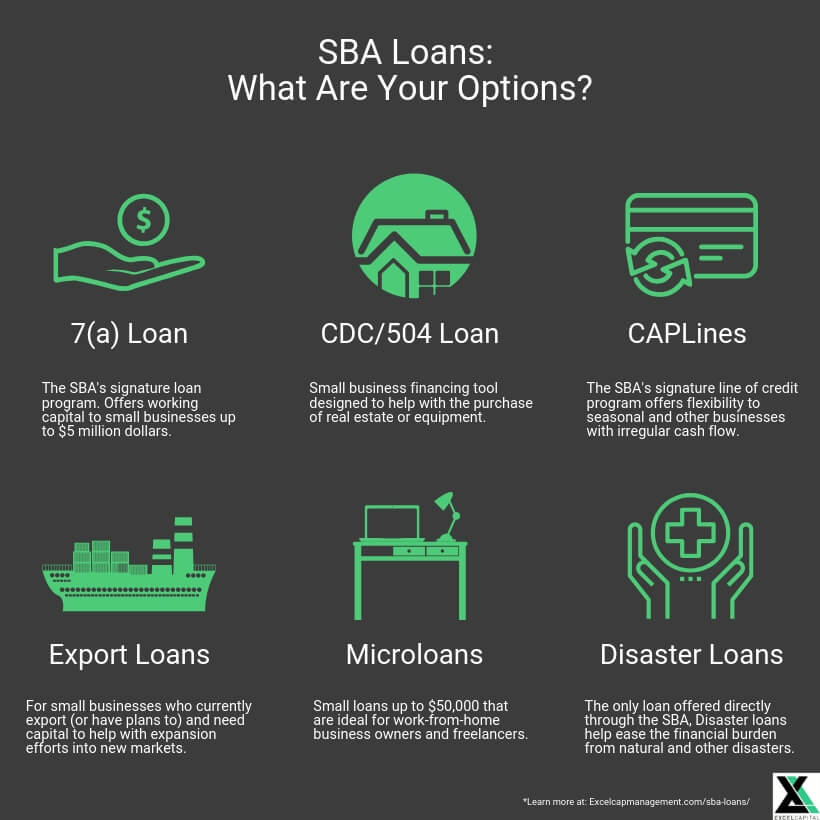

Sba Loans To Purchase Real Estate

The SBA will guarantee loans of up to $5 million. Loan proceeds can be used to purchase real estate, make improvements to business property, purchase. The SBA secures the loans for private lenders, who then disperse and collect the funds from business borrowers. Real Estate and Equipment Loans. As the term. Small businesses buying real estate can use an SBA loan for % financing. No down payment gives you more options. SBA loans can be used to purchase a business along with its real estate. In loan will be a weighted average of the business and real estate property values. The SBA will loan of up to $5 million. Loan proceeds can be used for working capital, to purchase real estate, make improvements to business property, purchase. Low down payment as little as 10% · Can be used to finance equipment and build, improve, refinance or purchase owner-occupied commercial real estate. Commercial real estate loans are more straightforward but higher interest rate and the real estate would have to appraise for the entire purchase amount. CDC/SBA loans can help new and existing business owners purchase or refinance an owner-occupied commercial property. This loan is technically considered two. Under the SBA Loan Program, FCF/FFC works with private-sector lenders to provide eligible small business owners in Alabama, Florida, and Georgia with below-. The SBA will guarantee loans of up to $5 million. Loan proceeds can be used to purchase real estate, make improvements to business property, purchase. The SBA secures the loans for private lenders, who then disperse and collect the funds from business borrowers. Real Estate and Equipment Loans. As the term. Small businesses buying real estate can use an SBA loan for % financing. No down payment gives you more options. SBA loans can be used to purchase a business along with its real estate. In loan will be a weighted average of the business and real estate property values. The SBA will loan of up to $5 million. Loan proceeds can be used for working capital, to purchase real estate, make improvements to business property, purchase. Low down payment as little as 10% · Can be used to finance equipment and build, improve, refinance or purchase owner-occupied commercial real estate. Commercial real estate loans are more straightforward but higher interest rate and the real estate would have to appraise for the entire purchase amount. CDC/SBA loans can help new and existing business owners purchase or refinance an owner-occupied commercial property. This loan is technically considered two. Under the SBA Loan Program, FCF/FFC works with private-sector lenders to provide eligible small business owners in Alabama, Florida, and Georgia with below-.

Under the SBA Loan Program, FCF/FFC works with private-sector lenders to provide eligible small business owners in Alabama, Florida, and Georgia with below-. Small business, owner-occupied real estate is eligible for SBA government-guaranteed financing with lower down payments, longer repayment terms, and easier. An SBA loan only requires a 10% down payment, compared to traditional commercial loans that require 20% to 40% down payments. The SBA 7a loan is a great option to help you refinance or purchase your commercial property. Talk to one of our SBA Business Development Officers today! Small businesses can secure multiple SBA Green Loans, each with the maximum of $ million and an aggregate not to exceed $ million from SBA financing. An SBA loan is also guaranteed by the SBA. loans are designed specifically for the purchase of commercial real estate or heavy equipment. SBA financing eligibility is attributable to real estate that is “owned and occupied” by a small business. If buying an existing property, the small business. Many different small business loan types are available to purchase real estate, both from commercial banks and non-traditional lending sources. The SBA will guarantee up to 85 percent of the loan's value for loans as high as $,, and 75 percent for loans over $, SBA Express Loans act as. However, you will not be able to use this loan to pay off any existing debts or to purchase land or real estate for your home-based business. With the microloan. SBA Real Estate Loans. The SBA has two SBA Real Estate loans that can be used for real estate: The 7(a) and the CDC/ loan programs. The 7(a) program is a. No, you can't use an SBA loan to buy real estate investments like single-family or multifamily rentals. They can only fund owner-occupied real estate. The SBA 7(a) Program: The SBA's most popular loan program, 7(a) loans provide loans of up to $5 million to fund startup costs, including purchasing new land . The SBA offers several commercial real estate loans for buying or expanding property. Learn the fundamental differences between the loan programs. 7(a) loans. A loan that's used for business acquisition, real estate purchases, equipment, expansion, inventory, leasehold improvements, debt refinance and. SBA 7(a) Loans: This is the most common SBA loan program. It can be used for various purposes, including buying real estate, equipment, or for. The SBA Loan Program is designed to help growing businesses to expand and create new jobs by providing long-term financing for the purchase or upgrade of. It's well known that small business owners cannot use SBA loan funds to purchase investment properties and residential real estate, such as apartment. Businesses looking for funding options for large real estate and land projects might find what they need in the SBA loan program. The /CDC loan program. We found a bank that was willing to set us up with a SBA 7(a) loan that would require very little down and would have a very low prepayment penalty.

Learn Forex Trading For Beginners

You will learn a simple strategy that you can use as a beginner to start trading Forex · Understand how to trade The Forex market · Learn how to place a trade on. Forex Trading Guide for Beginners The Forex market may appear abstract, intimidating, and complex for a beginner trader. But its underlying mechanism is. The School of Pipsology is our free online course that helps beginners learn how to trade forex. If you've always wanted to learn to trade but have no idea. Welcome To The Free 'Beginners' FOREX Trading Introduction Course. This free forex education course was created to help beginner currency traders understand. Currency Trading Features: Online forex trading techniques; A Sample of Real Trade; Analysis Methods; Forex Guide: Top 5 Tips to Guide You. Learn Forex Trading. HOW TO START FOREX TRADING · Learn about the forex world: · Establish a brokerage account: · Create a trading strategy: · Maintaining a vigilant eye on your. Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4: Open a Trading Account · Step 5: Prepare a. 1 read naked forex · 2 pick a system from the book that you want to trade · 3 back test that system on trading view or forex tester 5 · 4 back test. 12 Lessons Easy About this course Master the basics of forex trading even if you have no trading experience. Learn more. You will learn a simple strategy that you can use as a beginner to start trading Forex · Understand how to trade The Forex market · Learn how to place a trade on. Forex Trading Guide for Beginners The Forex market may appear abstract, intimidating, and complex for a beginner trader. But its underlying mechanism is. The School of Pipsology is our free online course that helps beginners learn how to trade forex. If you've always wanted to learn to trade but have no idea. Welcome To The Free 'Beginners' FOREX Trading Introduction Course. This free forex education course was created to help beginner currency traders understand. Currency Trading Features: Online forex trading techniques; A Sample of Real Trade; Analysis Methods; Forex Guide: Top 5 Tips to Guide You. Learn Forex Trading. HOW TO START FOREX TRADING · Learn about the forex world: · Establish a brokerage account: · Create a trading strategy: · Maintaining a vigilant eye on your. Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4: Open a Trading Account · Step 5: Prepare a. 1 read naked forex · 2 pick a system from the book that you want to trade · 3 back test that system on trading view or forex tester 5 · 4 back test. 12 Lessons Easy About this course Master the basics of forex trading even if you have no trading experience. Learn more.

Forex trading is slightly different than that of stocks and bonds, but those differences can afford traders diversification as well as new opportunities. A comprehensive introduction to forex trading for beginners. Learn why people trade forex, what trading forex is and how you might make money doing it. Learning Forex as a beginner involves understanding the basics of currency trading and gradually advancing to more complex concepts. A good. My point is that whatever you do as a beginner Forex Trader, spend 90% of your time learning and practicing on demo accounts. 10% should be. Learning to trade forex as a beginner can be tough. See our forex trading guide for beginners, which provides essential knowledge for any new forex trader. Discover how to trade in forex with our beginner's guide. Learn what forex trading is, how the forex market works, and how to start trading today. Learn stock and forex trading in a friendly, risk-free trading simulator. ☆ Learn Faster. Trade Smarter. And have fun while learning about financial markets. Everything you need to know about trading on the foreign exchange market. Decipher jargon, learn about trading accounts, understand how brokers work and. In summary, here are 10 of our most popular forex trading courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Forex -. Beginner Questions · Trading Systems · Calendar · Economic Calendar · Tools Why Trade Forex? Why Trade Forex: Learn What Makes FX Trading Unique · Why. Start your trading education with y-j.site US. Learn how to trade with our interactive online trading courses ranging from beginner to advanced. Learn stock and forex trading in a friendly, risk-free trading simulator. Burn money, make mistakes, and have fun while learning about financial markets. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners. Babypips helps new traders learn about the forex and crypto markets without falling asleep. We introduce people to the world of trading currencies, both fiat. What you'll learn · Have a full understanding of how the Forex Market operates · Tell the difference between Base & Quoted currencies · Select a Forex Broker for. Forex is a Forex trading course designed to help even absolute beginners learn how to trade. The training course is absolutely free and % online. Learn how the forex market works, how its products are priced, and how trading works in this large marketplace. WHAT'S ON THIS PAGE? What is the forex market? Various Chinese RMB currency denominations. Tips for forex trading beginners Optimistic trader - example for a y-j.site trading academy course. A comprehensive Forex academy offering free lessons, like FX Academy, provides an excellent start to beginners who are excited about Forex trading and seek well.

How To Transfer Credit Card To Another Credit Card

Note your current balances and the interest rates for each. · For a new credit card introductory offer, many applications include the option to request the. If you have two credit cards and you want to transfer the balance (or some of it) across from one to the other, all you have to do is inform the supplier. Step 1: Check your current balance and interest rate · Step 2: Choose the right credit card for you · Step 3: Apply for a credit card · Step 4: Transfer the. A credit card balance transfer does just what its name implies — it transfers the balance on a credit card or credit account to another account. Apply for a balance transfer credit card. Remember that applying for a new credit card can trigger a hard credit inquiry on your credit report which can impact. You may have to pay a balance transfer fee: Transferring your balance from one credit card to another typically costs a fee calculated based on the percentage. Do it yourself by performing a cash advance; Fill out your card issuer's form to have them process the transfer for you (this often includes a small fee). Cash. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. You may find balance transfer offers when you consider opening a new credit card account. In other cases, an existing credit card account might give you a. Note your current balances and the interest rates for each. · For a new credit card introductory offer, many applications include the option to request the. If you have two credit cards and you want to transfer the balance (or some of it) across from one to the other, all you have to do is inform the supplier. Step 1: Check your current balance and interest rate · Step 2: Choose the right credit card for you · Step 3: Apply for a credit card · Step 4: Transfer the. A credit card balance transfer does just what its name implies — it transfers the balance on a credit card or credit account to another account. Apply for a balance transfer credit card. Remember that applying for a new credit card can trigger a hard credit inquiry on your credit report which can impact. You may have to pay a balance transfer fee: Transferring your balance from one credit card to another typically costs a fee calculated based on the percentage. Do it yourself by performing a cash advance; Fill out your card issuer's form to have them process the transfer for you (this often includes a small fee). Cash. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. You may find balance transfer offers when you consider opening a new credit card account. In other cases, an existing credit card account might give you a.

Credit card companies offer the ability to transfer balances from one card to another, even if they're not held by the same person, as long as both parties. If you have a credit card with one card issuer, you won't be able to transfer your balance to another card offered by that same issuer. There's a transfer. The easiest way to transfer balances to your Visa® Credit Card is through Online Banking - it's quick and easy! A credit card balance transfer is a transaction where your new credit card issuer moves outstanding debt to a different credit card. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Credit limits are another factor to think about. When transferring credit card balances, you can only transfer a balance up to the amount of the credit limit on. You may typically request a balance transfer for a new or existing Capital One credit card online or over the phone. You may need to provide some information. Phone. To request a Balance Transfer by phone, call the number on the back of your card. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. How do credit card balance transfers work? · Decide which credit card to use. If you already have credit cards, review your current cards for available balance. For instance, if you have debt on a Citi card you can't transfer debt to another Citi card. And if you're looking to transfer debt from both a Citi card and a. Start by finding a credit card with a lower interest rate than your current card, then transfer your balance (or a portion of it) to the new card. Typically, balance transfer fees range from 3 to 5 percent of balance transfer amount. Let's say you want to transfer a credit card balance of $3, to a new. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. Applying for a balance transfer card is as simple as going to a credit card issuer's website and providing your name, address, Social Security number, income. A balance transfer means moving all or part of the debt from one or more credit cards to another credit card. Select your credit card. · Online banking: Choose Account services, then select Balance transfer from the "Payments" section. · Review the offers shown; when you. If you have two credit cards and you want to transfer the balance (or some of it) across from one to the other, all you have to do is inform the supplier.

Make Money From Books

Reedsy – With Reedsy Discovery, you can review hundreds of different books before they are published and earn money at the same time. Authors submit their books. About The Book How to Make Money on the Internet is the essential guide to making some extra cash on the side or even earning a living online. This clear. 1. Offer a paid newsletter · 2. Sell bonus material or extras related to your book · 3. Use affiliate marketing · 4. Display advertisement · 5. Offer consulting or. Each time I scan a book the app tells me how much money I would make if I sold that book on Amazon, and if I should buy it or not. 4. I buy the books the. Basically, there's no easy way to make money from your books. Let's look at traditional publishing first, and the different ways you can earn money. Making. Absolutely. There are some authors who make tons of money, and some who don't (but still make something). · How much you make largely depends on. Aside from publishing, other effective ways to earn money from writing include freelancing for businesses or websites, ghostwriting for clients. 2. Royalties and Earnings: Self-published authors often earn higher royalty rates, typically up to 70% per sale, compared to the % offered by traditional. Earn more with multiple income streams · Earn up to 70% royalties on eBook sales · Earn your share of the KDP Select Global Fund based on your book's pages read. Reedsy – With Reedsy Discovery, you can review hundreds of different books before they are published and earn money at the same time. Authors submit their books. About The Book How to Make Money on the Internet is the essential guide to making some extra cash on the side or even earning a living online. This clear. 1. Offer a paid newsletter · 2. Sell bonus material or extras related to your book · 3. Use affiliate marketing · 4. Display advertisement · 5. Offer consulting or. Each time I scan a book the app tells me how much money I would make if I sold that book on Amazon, and if I should buy it or not. 4. I buy the books the. Basically, there's no easy way to make money from your books. Let's look at traditional publishing first, and the different ways you can earn money. Making. Absolutely. There are some authors who make tons of money, and some who don't (but still make something). · How much you make largely depends on. Aside from publishing, other effective ways to earn money from writing include freelancing for businesses or websites, ghostwriting for clients. 2. Royalties and Earnings: Self-published authors often earn higher royalty rates, typically up to 70% per sale, compared to the % offered by traditional. Earn more with multiple income streams · Earn up to 70% royalties on eBook sales · Earn your share of the KDP Select Global Fund based on your book's pages read.

Discover the best books on how to make money. Explore expert advice and practical tips for increasing your income and building wealth. You can find tons of free resources on marketing, or you can buy (warily) any number of books about marketing ebooks online. You can also talk to someone who's. Sell Your Book (Everywhere!) · Sell your book through online marketplaces such as Amazon · Upload your book to IngramSpark, making it accessible to big-name. Sell your old books to make money! Just enter the ISBN and get an instant valuation. Post for FREE and get paid the next day, once we receive your books. So in this article, I'm going to condense all of these books into the core lessons that will actually make you rich. And no, I'm not just saying. Tips for making money from your eBook · Choose a popular topic for your eBook. person holding kindle ebook · Write your eBook to a high standard · Choose the best-. The best books about making money · 1. Rich Dad Poor Dad – Robert Kiyosaki · 2. The 4-Hour Workweek – Tim Ferriss · 3. Broke Millenial – Erin Lowry · 4. Think. 1. Kirkus Review. Kirkus Review is a highly reputable website that reviews books of all genres and formats. · 2. Booklist. Booklist is part of the American. Other ways authors make money · Authors and publishers do not get paid for eBooks or audiobooks, only print books. · Authors (and publishers) are only paid if. Write a smaller book on your topic and put it for free permanently on Amazon. This will drive a lot of traffic inside of your book, then put a link inside your. Yes. I've made more money selling paper copies of books I've published than I have selling eBooks. You're unlikely to become wealthy, but. Get Paid to Read Books You Love: 10 Viable Options You Can Pursue Today · 1. Critique Partner. A critique partner, otherwise known as a CP, is a fellow writer. Earn royalties for pages read in Kindle Unlimited · Reach a larger audience · Earn your share of the KDP Select Global Fund · Maximize your book's sales potential. You can easily understand the procedure to make money by selling books on Amazon. First of all, you need to choose the means to source the books. Many successful children's book authors—whether traditionally published or self-published—make additional income through offering workshops and Q&A sessions to. 5 Ways Authors Can Make Money Outside of Selling Books · 1. Launching a Blog · 2. Creating an Online Course · 3. Podcasting · 4. Speaking and Lecturing · 5. Publish Books on Amazon Kindle Direct; Become a getAbstract Freelance Writer; Teach English Literature; Edit eBooks for Businesses; Become a Book Blogger. in Calgary, Alberta. Money Wise Mabel's Bursting Bank is her first book for children. Her title, Make Money Your Thing, will be released by RE: Books in Spring. Amazon is one of the most popular platforms for self-publishing, and it offers a range of royalty options. With Amazon, you can earn up to 70% royalties per. Earn royalties for pages read in Kindle Unlimited · Reach a larger audience · Earn your share of the KDP Select Global Fund · Maximize your book's sales potential.