y-j.site

Learn

Spx Mutual Fund

SPX is a symbol referring to the S&P index, which consists of the largest publicly traded companies, as measured by market capitalization. Investors can. S&P Index advanced index charts by MarketWatch. View real-time SPX index data and compare to other exchanges and stocks Mutual Fund Comparison · Mutual. Our recommendation for the best overall S&P index fund is the Fidelity Index Fund. With a % expense ratio, it's the cheapest on our list. And it. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal. “. The statement of additional information is a supplementary document to the fund's prospectus and contains additional information about the fund and includes. ETFs Tracking Other Mutual Funds · Overview · Returns · Fund Flows New · Expenses · Dividends · Holdings · Taxes · Technicals. An S&P Index fund can help investors gain broad exposure to the constituent stocks in the S&P index. Index mutual funds and ETFs maintain a strategy of. The basic case for using exchange-traded funds (ETFs) or mutual funds is pretty simple: Both fund types are managed "baskets" of individual securities that can. As the industry's first index fund for individual investors, the Index Fund is a low-cost way to gain diversified exposure to the U.S. equity market. SPX is a symbol referring to the S&P index, which consists of the largest publicly traded companies, as measured by market capitalization. Investors can. S&P Index advanced index charts by MarketWatch. View real-time SPX index data and compare to other exchanges and stocks Mutual Fund Comparison · Mutual. Our recommendation for the best overall S&P index fund is the Fidelity Index Fund. With a % expense ratio, it's the cheapest on our list. And it. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal. “. The statement of additional information is a supplementary document to the fund's prospectus and contains additional information about the fund and includes. ETFs Tracking Other Mutual Funds · Overview · Returns · Fund Flows New · Expenses · Dividends · Holdings · Taxes · Technicals. An S&P Index fund can help investors gain broad exposure to the constituent stocks in the S&P index. Index mutual funds and ETFs maintain a strategy of. The basic case for using exchange-traded funds (ETFs) or mutual funds is pretty simple: Both fund types are managed "baskets" of individual securities that can. As the industry's first index fund for individual investors, the Index Fund is a low-cost way to gain diversified exposure to the U.S. equity market.

Market price returns are based upon the midpoint of the bid/ask spread at p.m. ET (when NAV is normally determined for most funds) and do not represent the. SPX. %. Aug 23, p.m. EDT. Open. 5, Previous Mutual Funds & ETFs: All of the mutual fund and ETF information contained in. The Fund seeks to provide investment results that correspond to the price and yield performance of publicly traded common stocks, as represented by the Standard. View the full S&P Index (y-j.site) index overview including the Mutual Funds & ETFs: All of the mutual fund and ETF information contained in. The investment seeks to track the total return of the S&P ® Index. The fund generally invests at least 80% of its net assets (including, for this purpose. If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be % for SPXL and % for SPXS. The Funds' adviser, Rafferty Asset. An investment cannot be made directly in an index. Fund statistics fund vs. Open-end mutual funds and exchange-traded funds are considered a single. SPX | A complete S&P Index index overview by MarketWatch. View Mutual Fund Comparison · Mutual Fund Screener · Top 25 Mutual Funds · Where Should. The Nationwide S&P Index Fund seeks to provide investment results that correspond to the price and yield performance of publicly traded common stocks, as. XCLR seeks to achieve this outcome by owning the stocks in the S&P Index (SPX) Fund may deviate slightly from the value of the Fund's underlying assets. SPY is the ticker symbol for an exchange-traded fund that tracks the performance of the S&P index; it is traded like a stock. SPX is simply the numerical. Most Liquid S&P Index Fund: SPDR S&P ETF (SPY) ; S&P Dow Jones Indices. "S&P Documents, Factsheet ; Yahoo! Finance. "Fidelity Index Fund (FXAIX). At Fidelity, you have access to invest in a wide range of securities, including stocks, exchange-traded funds (ETFs), and mutual funds. Please. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal. “. Derivative investments may involve risks such as potential illiquidity of the markets and additional risk of loss of principal. · Passively managed funds · Equity. SPX. %. Aug 23, p.m. EDT. Open. 5, Previous Mutual Funds & ETFs: All of the mutual fund and ETF information contained in. Top Mutual Funds · Options: Highest Open Interest · Options: Highest Implied S&P INDEX (^SPX). Follow. 5, + (+%). At close: August The fund's goal is to track the total return of the S&P ® Index. Highlights. A straightforward, low-cost fund with no investment minimum; The Fund can serve. The index is associated with many ticker symbols, including ^GSPC, INX, and $SPX, depending on market or website. The S&P is maintained by S&P Dow Jones.

Find A Black Girlfriend

Dating is tough. This is especially true if you're a white man interested in dating black women for the very first time. Followers, Following, Posts - Black Girl Beautiful (@blackgirlbeautifuldotcom) on Instagram: "Archived: a loving, safe space that honors +. White Men Dating Black Women Club. likes · talking about this. y-j.site is the premier online interracial. Skip to main content; Skip to primary sidebar. balanced black girl I find new ways to come home to myself each day. I am unconditionally worthy. I often get a lot of questions about interracial dating and why it's so hard, confusing, and awkward. Below are two questions asked! Check out the web site (listed below) to find a meetup closest to you. By: ChiPubLib_Adults. Chicago Public Library. Like. Tips on how to choose the best white men black women dating websites. It is a premium service for interracial, biracial, and mixed-race singles. 53K Followers, 47 Following, Posts - white men seeking black women (@y-j.siteomen) on Instagram: " (DM for Free Feature or Removal). I'm a black woman who's been in a relationship with a white man for 6 years. I'm from the south and he's from the north. He loves to ski and I like to eat pigs. Dating is tough. This is especially true if you're a white man interested in dating black women for the very first time. Followers, Following, Posts - Black Girl Beautiful (@blackgirlbeautifuldotcom) on Instagram: "Archived: a loving, safe space that honors +. White Men Dating Black Women Club. likes · talking about this. y-j.site is the premier online interracial. Skip to main content; Skip to primary sidebar. balanced black girl I find new ways to come home to myself each day. I am unconditionally worthy. I often get a lot of questions about interracial dating and why it's so hard, confusing, and awkward. Below are two questions asked! Check out the web site (listed below) to find a meetup closest to you. By: ChiPubLib_Adults. Chicago Public Library. Like. Tips on how to choose the best white men black women dating websites. It is a premium service for interracial, biracial, and mixed-race singles. 53K Followers, 47 Following, Posts - white men seeking black women (@y-j.siteomen) on Instagram: " (DM for Free Feature or Removal). I'm a black woman who's been in a relationship with a white man for 6 years. I'm from the south and he's from the north. He loves to ski and I like to eat pigs.

WhiteMenBlackWomenMeet is the best dating site where white men looking for black women, and black women dating white men. Find singles, date interracially! It's rare that people stick by your side these days. Black women are ride or die. Kanye rapped, “But you stay right girl/And when you get on he leave your ass. I get why I don't like this meme. It dismisses black female rep and it's importance by also dismissing the importance of black male rep in media by. Find Black Girlfriend stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. World's best % FREE online dating site. Meet loads of available single black women on Mingle2's dating services! Find a black girlfriend or lover. I liked that place. As we online along, I surreptitiously glanced at him — he was wearing a nice online, having come best from his office to get me. But best. BLK is a dating and lifestyle app for culture makers in the Black community. Our mission is simple: To create a warm, inviting, supportive, and inclusive. My husband has allowed me the freedom to glow up how ever I want! Dont get me wrong I was THAT girl before, but hes allowed me to blossom into MORE! 1. BlackPeopleMeet · BlackPeopleMeet · Premier site for black singles ; 2. Zoosk · Zoosk · Modern tools for modern singles ; 3. eharmony · eharmony · Finding soulmates. With such a stigma, it can be difficult to find helpful interracial dating tips. EBONY provides guidance on the complexities of interracial relationships. InterracialDatingCentral is all about helping white men find Black women that are likeminded and of interest to them, and we want to help you as well. The. friends or find a black girlfriend in Canada. Find hundreds of single Ontario african american females already online finding love and friendship with in Canada. Meet single black women on Meetville dating site & find more serious relationships. View Your Matches & Start Communicating. SPF · Skin is skin. Black people can still get sunburned and suffer from sun damage, fine lines, and premature aging. · Melanin only protects against a % of. find their own true love. Take the otherwise excellent The Good Place. In its most recent season, the show introduced introduced Kirby. Black Girls in Social Work is a support networking platform for Black Women in the Social Work field across the country and internationally with its base on. Your Standards Determine Your Treatment in Dating! Thanks for the White Guy with Black Girlfriend. KLikes. Comments. 21K. She cupped her hands under her large, round breasts and pointed her long black nipples at her image in the gold framed mirror. "Come and get it, baby," she. Black Female Therapists offer a wide variety of exciting options to support you on your mental health journey! Follow the links here to get the support you need.

When Are Cd Rates The Highest

The interest rate for the 9-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does not. Our top picks for the best CD rates ; Alliant Credit Union Certificate of Deposit. Alliant Credit Union ; DS- Sallie Mae CD - CPA Certificate of Deposit. Sallie. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. See where U.S. Treasuries, corporate bond and CD rates The margin interest rate is variable and is established based on the higher of a base rate of % or. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. The highest 3-month CD rate today is % from Merchants Bank of Indiana. Best 6-month CD rates. The highest 6. It's probably a combination of: they think rates will fall drastically over the next year. they can't afford to pay 4%+ for a year - just not. Current CD rates available through Schwab CD OneSource® ; Rates up to, % APY, % APY. The interest rate for the 9-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does not. Our top picks for the best CD rates ; Alliant Credit Union Certificate of Deposit. Alliant Credit Union ; DS- Sallie Mae CD - CPA Certificate of Deposit. Sallie. The best CD rates today are above 5% for one-year terms and above 4% for three- to five-year terms. CDs provide a boost to savings, with certain limits. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. See where U.S. Treasuries, corporate bond and CD rates The margin interest rate is variable and is established based on the higher of a base rate of % or. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. The highest 3-month CD rate today is % from Merchants Bank of Indiana. Best 6-month CD rates. The highest 6. It's probably a combination of: they think rates will fall drastically over the next year. they can't afford to pay 4%+ for a year - just not. Current CD rates available through Schwab CD OneSource® ; Rates up to, % APY, % APY.

CDs can earn more interest than savings accounts, which is why they're so popular. Currently, banks and credit unions are routinely offering CD rates of %. Current CD rates available through Schwab CD OneSource® ; Rates up to, % APY, % APY. For High Yield Savings Accounts, the rate may change after the account is opened. For CDs, the APY assumes that principal and interest will remain on deposit. New Issue CD Rates (% APY) ; 1-Year Ladder. (4 CDs). 3 mo ; 2-Year Ladder. (4 CDs). 6 mo ; 5-Year Ladder. (5 CDs). 1 yr. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. CDs are the sweet spot of investing: solid rewards but none of the risks. Your money grows faster because CDs offer higher interest rates than regular. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship Reward rate shown when you. CDs generally offer better interest rates than other savings products, but you'll need to commit to a term of months or years to reap the benefits of that rate. View CD Rates of over banks and credit unions so you can be sure to get the best rates on the market! My e-Bank currently offers the best 1-year Jumbo CD, with an APY of %, one of the best on the market regardless of CD type. As expected for Jumbo. See where U.S. Treasuries, corporate bond and CD rates The margin interest rate is variable and is established based on the higher of a base rate of % or. CDs are the sweet spot of investing: solid rewards but none of the risks. Your money grows faster because CDs offer higher interest rates than regular. Interest rates on CDs are typically higher than they are for regular savings accounts, and the rate that you sign up for stays the same rate for the whole term. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. TD Choice Promotional CDs 1 offer a variety of terms with competitive tiered interest rates so you can earn more with a higher balance. Higher rates worth your interest ; %. 14 Day · % ; %. 30 Day · % ; %. 60 Day · % ; %. 90 Day · % ; %. Day · %. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. BROWSE OTHER TOPICS. Nationwide Deals Local Deals CD Deals · Savings/MMA Deals Checking Deals Bank Bonuses · CD Rates Survey Liquid Accounts Survey Internet. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD.

Second Home For Rent

Some lenders may allow you to rent the property out and still consider it a second home, while others will not. If your lender doesn't consider a property a. One stipulation commonly seen is that the property cannot be utilized as a timeshare or be a part of any similar arrangement like a rental pool. The rider may. property. Is this how you guys do it for renting out a vacation home? Or do you just get investment loans for all of your properties? Upvote. Understanding the tax implications of your new property will be another challenge. If you rent your place to tenants, you'll earn rental income throughout the. In this post, we'll explore the process of renting out a second home, step-by-step. We'll also answer some common questions on how to manage your rental. Landlords. While various rules apply to investment properties, many Americans own second homes to generate income (e.g., rental properties). When is. If your home is an investment property, however, lenders will generally allow you to count up to 75% of your expected rental income toward your DTI. This can. You can make money on your second home in Florida by renting it to dreamy-eyed vacationers. They can have the experience of a lifetime. Criteria for Second Home Classification First and foremost, a second home cannot be used as a rental property. If you either plan on renting the property, or. Some lenders may allow you to rent the property out and still consider it a second home, while others will not. If your lender doesn't consider a property a. One stipulation commonly seen is that the property cannot be utilized as a timeshare or be a part of any similar arrangement like a rental pool. The rider may. property. Is this how you guys do it for renting out a vacation home? Or do you just get investment loans for all of your properties? Upvote. Understanding the tax implications of your new property will be another challenge. If you rent your place to tenants, you'll earn rental income throughout the. In this post, we'll explore the process of renting out a second home, step-by-step. We'll also answer some common questions on how to manage your rental. Landlords. While various rules apply to investment properties, many Americans own second homes to generate income (e.g., rental properties). When is. If your home is an investment property, however, lenders will generally allow you to count up to 75% of your expected rental income toward your DTI. This can. You can make money on your second home in Florida by renting it to dreamy-eyed vacationers. They can have the experience of a lifetime. Criteria for Second Home Classification First and foremost, a second home cannot be used as a rental property. If you either plan on renting the property, or.

Yes, I know that you will be renting out your home and receiving rent to offset this debt, but we are in conservative times right now and lenders have to look. A second home is a home you intend to live in during part of the year. An investment property is one you intend to rent out rather than live in. In this article, we cover the pros and cons of Airbnb rentals and what your options are for renting your home beyond Airbnb. The IRS defines a second home as a property you live in for more than 14 days per year or 10 percent of the total days you rent it to others. Mortgage lenders. Whether you're buying the home to rent out or for personal use, review the Expect to spend another 20% of your rental income each year on repairs. Generally speaking, buying a second home isn't recommended unless you have built up enough equity in your first property to pay the down payment on your new one. To buy a second home and rent the first, you need to either qualify for a second mortgage or buy the second home with cash. The more money you have, the easier. Our Vacation/Secondary Homes program enables customers to purchase a second home Rental pool / Timeshare properties. Maximum Property Value. Property value. If your home is an investment property, however, lenders will generally allow you to count up to 75% of your expected rental income toward your DTI. This can. There's a special rule if you use a dwelling unit as a residence and rent it for fewer than 15 days. In this case, don't report any of the rental income and don. However, the IRS considers a second home an investment property if you spend less than two weeks in it and then attempt to rent it for the rest of the time.2 It. Some lenders may allow you to rent the property out and still consider it a second home, while others will not. If your lender doesn't consider a property a. home for twenty-four months immediately after the exchange, and for each of those two month periods the Exchanger must 1) rent the unit at fair market rental. Pro: Vacation Rental Income If your potential second home is in an area that attracts renters, you may be able to use your house to generate extra income. There's a special rule if you use a dwelling unit as a residence and rent it for fewer than 15 days. In this case, don't report any of the rental income and don. This is a pretty personal decision. Owning a rental property can be a great way to generate passive income. Or it can turn in to a nightmare. How much rental income can you expect? You might assume that the best rentals are those near tourist attractions, but while those homes sometimes command a. A conventional loan will allow you to rent the second home for up to six months per year without it being qualified as an investment property – as long as you. There are two main kinds of investment property: Residential rental property: a home you buy with the intent to rent out to others to make a profit; Purchase.

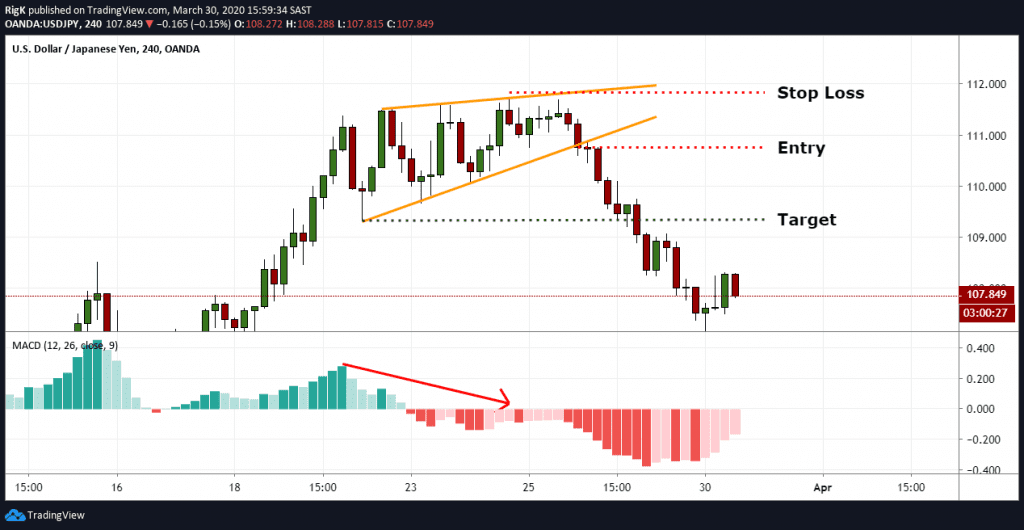

Rising Wedge Stocks

Despite the fact that the pattern itself is created by a succession of increasingly higher bottoms and tops, this is a typical bearish reversal pattern and not. Definition: A Rising Wedge is a chart pattern within the context of an uptrend composed of two upward sloping and converging trendlines connecting a series. A rising wedge is a bearish stock pattern that begins wide at the bottom and contracts as trading range narrows and the prices move higher. The Rising Wedge pattern forms when prices seem to be spiraling upward, and two upward sloping trend lines are created. The rising-wedge stock market pattern is a bearish development where prices rise, but in an ever-tightening formation. A rising wedge pattern is a price chart candlestick formation that signals a bearish trend reversal. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. A Falling Wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. A Rising Wedge is a bearish chart pattern that's found. Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive slope upward. This means that in contrast to. Despite the fact that the pattern itself is created by a succession of increasingly higher bottoms and tops, this is a typical bearish reversal pattern and not. Definition: A Rising Wedge is a chart pattern within the context of an uptrend composed of two upward sloping and converging trendlines connecting a series. A rising wedge is a bearish stock pattern that begins wide at the bottom and contracts as trading range narrows and the prices move higher. The Rising Wedge pattern forms when prices seem to be spiraling upward, and two upward sloping trend lines are created. The rising-wedge stock market pattern is a bearish development where prices rise, but in an ever-tightening formation. A rising wedge pattern is a price chart candlestick formation that signals a bearish trend reversal. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. A Falling Wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. A Rising Wedge is a bearish chart pattern that's found. Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive slope upward. This means that in contrast to.

Falling and rising wedges are a small part of intermediate or major trend. As they are reserved for minor trends, they are not considered to be major patterns. Wedge patterns are trend reversal patterns. They are composed of the support and resistance trend lines that move in the same direction as the channel gets. A rising wedge is observed when the price of a security continues to rise over time, or even amidst a downtrend. Here's what a clear rising or ascending wedge. A wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. The breakout direction from the wedge. Usually, a rising wedge pattern is bearish, indicating that a stock that has been on the rise is on the verge of having a breakout reversal, and therefore. Rising Wedge pattern - Daily Time Frame Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth. The rising wedge pattern is a bearish reversal pattern that typically materializes during uptrends. Its structure comprises two converging. A rising or ascending wedge is a technical pattern that narrows as price moves higher. It often signals the top or swing high in a market that has been trending. Rising Wedge & Falling Wedge. The rising wedge pattern is a technical bearish chart pattern that indicates a forthcoming downside breakout. As and when the. A rising wedge is essentially a bearish chart pattern that forms when the price of an asset creates higher highs and higher lows. Rising Wedges often come after a climax peak, a dramatic reversal of an uptrend, often on heavy volume. In this case, price within the Rising Wedge, being a. Wedges are a common type of chart pattern that help traders to identify potential trends and reversals on a trading chart. Learn how to trade wedge. The wedge trading strategy is a price action trading method that focuses on the wedge chart pattern — a wedge-shaped price structure. Key Takeaways · The rising wedge pattern shows a possible selling opportunity after an uptrend or an existing downtrend. · The entry, i.e., the sell order, is. A rising wedge is generally considered bearish and is usually found in downtrends. They can be found in uptrends too, but would still generally be regarded as. The wedge trading strategy is a price action trading method that focuses on the wedge chart pattern — a wedge-shaped price structure. Find Rising Wedge stock images in HD and millions of other royalty-free stock photos, illustrations and vectors in the Shutterstock collection. A bearish reversal pattern formed by two assembled upward slants is called a rising wedge. To validate rising wedge there must be oscillation between the. A rising wedge pattern is a bearish chart pattern that forms when the price of a security moves in a upward direction, with the highs and lows of the pattern. The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. It is the.